irs child tax credit 2021

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. In the meantime the expanded child tax credit and advance monthly payments system have expired.

Child Tax Credit 2021 8 Things You Need To Know District Capital

The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families.

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

. The 500 nonrefundable Credit for Other Dependents amount has not changed. Updated 603 PM ET Mon July 12 2021. Get the up-to-date data and facts from USAFacts a nonpartisan source.

Ad Schedule 8812 More Fillable Forms Register and Subscribe Now. The credit increased from 2000 per. The recently passed third stimulus relief package known as the American Rescue Plan greatly expanded the Child Tax Credit.

Is the Child Tax Credit for 2020 or 2021. It increases the credit amount. Beginning with your tax year 2021 taxes the ones filed in 2022 now you get additional CTC of the amount of 1000 1600 in some cases to the already allowed 2000 of the child tax credit in the tax year 2021.

3600 for children ages 5 and under at the end of 2021. The Internal Revenue Service IRS will use your 2019 or 2020 tax return whichever was filed most recently or information you entered in the IRS. The JCT has made estimates that the TCJA changes.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. 112500 if you are filing as a head of household.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Dont Miss an Extra 1800 per Kid.

So every eligible parent may. The credit is increased to 3600 for children less than 6 years old. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

3000 for children ages 6 through 17 at the end of 2021. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. From january to december 2022 taxpayers will continue to receive the advanced child tax credit payments as usual.

As a result of the american rescue act the child tax credit was expanded to. Katrena Ross started receiving 300 a month last July as part of the expanded monthly child tax credit payments. The Michigan mother of three including a son with autism used the money to pay.

These changes reflect that Publication 972 Child Tax Credit has become obsolete. 150000 for a person who is married and filing a joint return. Free means free and IRS e-file is included.

You can find materials to share at 2021 Child Tax Credit and Advance Child Tax Credit Payments. Ad Discover trends and view interactive analysis of child care and early education in the US. If you opt out of advance payments you are choosing to receive your full Child Tax Credit 3600 per child under age 6 and 3000 per child age 6 to 17 when you file your 2021 tax return which you file in 2022.

You will receive either 250 or 300 depending on the age of. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. CNN Eligible parents will begin receiving the first monthly installment of the new enhanced child tax credit starting on July 15.

The monthly payments are advances on 50 of the CTC that you can claim on your 2021 tax returns when you file your taxes in early 2022. The IRS distributed half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The credit increased from 2000 per child in 2020 to 3600 in 2021 for each child under age 6. IRS Child Tax Credit Money. The IRS has confirmed that theyll soon allow claimants to adjust their.

Schedule 8812 Form 1040 is now used to calculate child tax credits and to report advance child tax credit payments received in 2021 and to figure any additional tax owed if excess advance child tax credit payments. The new bill known as the American Rescue Plan includes the following changes to this tax credit for tax year 2021. The Child Tax Credit is a fully refundable tax credit for families with qualifying children.

The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families. It increases the credit amount from 2000 to 3000 for children 6- 17. The Child Tax Credit Update Portal is no longer available.

Tax Refund Schedule 2022 If You Claim Child Tax Credits. The IRS will continue to provide materials on how to claim the 2021 Child Tax Credit as well as how to reconcile your advance Child Tax Credit payments with the amount of 2021 Child Tax Credit for which you are eligible. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

Taxpayers should refer to Schedule 8812 Form 1040. Max refund is guaranteed and 100 accurate. 112500 for a family with a single parent also called Head of Household.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. The 2021 Earned Income Tax Credit provides a tax break for low-income workers and families based on their wages salaries tips and other pay as well as earnings from self-employment. The remainder will come when parents file their 2021 tax returns next.

Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. Most parents who received monthly payments in 2021 will have more child tax credit money coming this year.

2021 Child Tax Credit Advanced Payment Option Tas

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Irs Urges Parents To Watch For New Form As Tax Season Begins

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Now Available To Puerto Rico Puerto Rico Report

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc11 Raleigh Durham

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Will You Have To Repay The Advanced Child Tax Credit Payments Wdtn Com

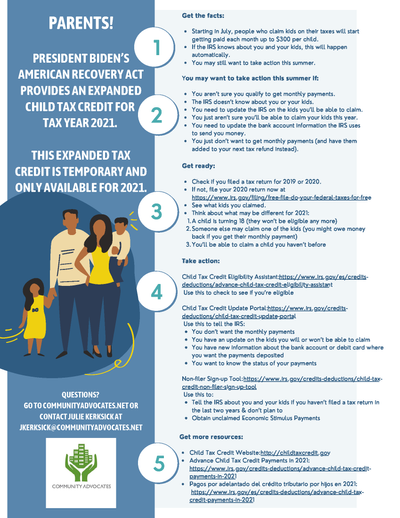

Child Tax Credit What We Do Community Advocates

The Child Tax Credit Toolkit The White House

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants